Kemi Osukoya, THE AFRICA BAZAAR MAGAZINE

August 20, 2019

EXCLUSIVE: The Trump administration said on Tuesday its sanctions against Iran will not have negative impacts on global oil markets and the U.S. economy.

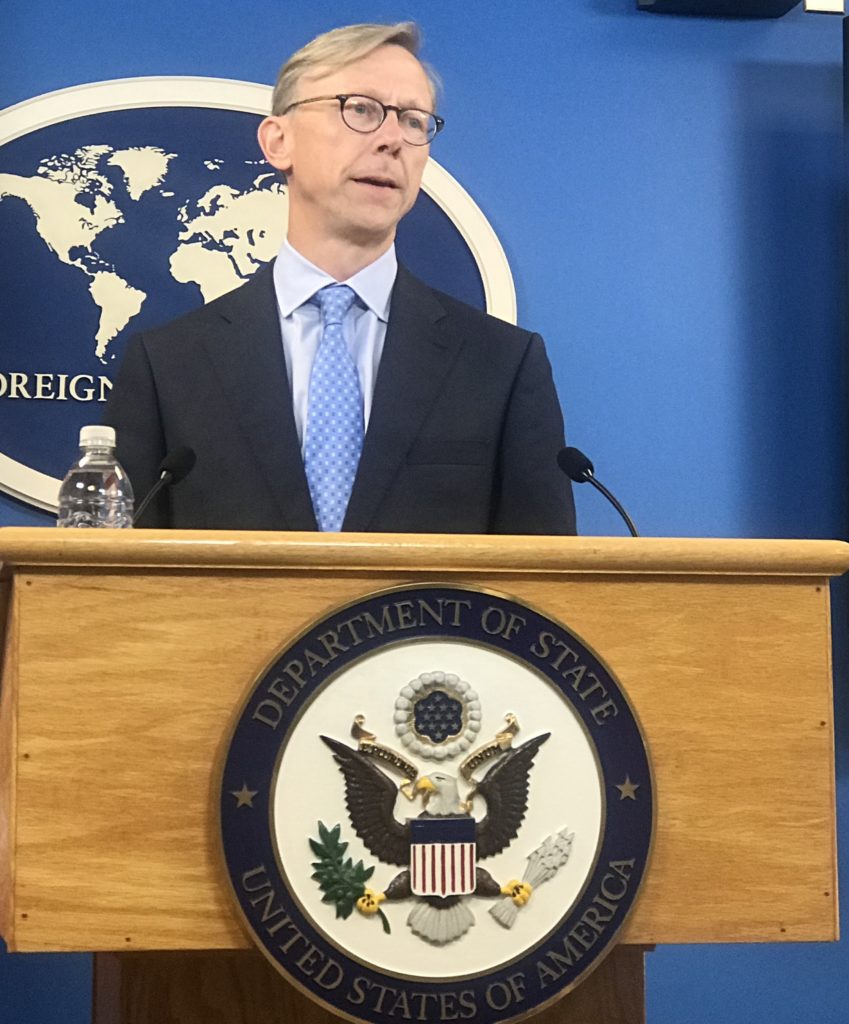

In an exclusive interview with Africa Bazaar magazine, U.S. Special Representative for Iran and Senior Policy Advisor to the Secretary of State Brian Hook said the administration has taken necessary steps to protect its economic and national security interests as well as the global market from any adverse consequences that may arise from its sanctions against Iran.

“Since the United States left the Iran deal, we have effectively zeroed out Iran oil exports and have brought down the price of oil,” said Mr. Hook who was part of a delegation accompanying Secretary of State Mike Pompeo to a special United Nations Security Council meeting on Iran on Tuesday. “The U.S. at the President’s direction had successfully balanced our economic and national security interests by steadily zeroing out Iran’s oil exports to balance these objectives.”

He added that oil prices have come down since the U.S. announced its sanctions against Iran last year. “Iran’s oil exports represents 3 percent of the world’s oil supply. When the President left the Iran deal, Brent was trading at $74, one year later, after we announced zero imports of running crude oil, Brent was trading at $72. We have been very smart about ensuring a well supplied and stable oil market,” said Mr. Hook.

In Spring 2018, the Trump administration withdrew the U.S. from the Joint Comprehensive Plan of Action agreement signed between Iran, P5+1 (the five permanent members of the U.N security council: China, France, Russia, United Kingdom and U.S) and the European Union under the Obama administration, and reimposed sanctions against Iran in efforts to weaken Iran’s economy and oil production.

Mr. Hook was quick to note during the interview that, “Iran’s oil, there’s nothing exotic about Iranian oil. It has many compatible grades around the Middle East, including Saudi Arabia and United Arab Emirates, and the U.S. have offset the loss of every Iranian barrel from the global oil supply. We’ve done that very responsibly.”

On Tuesday, Brent was trading around $60, Wall Street ended the financial market day lower, emblematic that investors continue to fret about the status of the global economy, U.S.- China trade war and U.S. interest rates in regards to Federal Reserve Chairman Jerome Powell‘s upcoming speech this Friday.

With oil markets in constant flux, analysts are concerned about the effects that U.S. sanctions on Iran and a potential oil prices plunge could have on African countries like Algeria, Angola, Congo, Equatorial Guinea, Gabon, Libya and Nigeria, all major oil producers in Africa as well as members of the Organization of Petroleum Exporting Countries which also include Iran, Iraq, Venezuela, Kuwait, UAE, and Qatar and Saudi Arabia. Angola, Equatorial Guinea and Nigeria, the top three largest oil producers in Sub-Saharan Africa, receive substantial amount of their revenues from oil.

Analysts said Nigeria, African largest economy, is especially vulnerable right now given that it recently exit a painful economic recession. Another oil market plunge could adversely affect the country, and heckle its recovery progress and diversification efforts of stabilizing the nation’s economy.

Aside from the domestic proximity of these African nations to the oil consortium, financial analysts said with issues like tariffs and trade war remaining pertinent in the context of global economy, on the international level, some investors are looking at alternative investments while others are holding on firmly to their funds instead of investing in the markets.

These sentiments are underscored in a commentary written by Stephanie Segal, Senior fellow, Simon Chair in Political Economy at the Center for Strategic and International Studies, a Washington D.C.-based think tank, in which she noted that though U.S. sanctions against Iran will achieve its ultimate purpose of inflicting economic pain on Iran, unpopular unilateral U.S. actions could affect the U.S. dollar on the long-term, giving some allies in Europe or rivals like China incentives to look for alternatives, potentially limiting the effectiveness of future sanctions.

*The interview was jointly conducted with TRT Washington.