Kemi Osukoya

THE AFRICA BAZAAR MAGAZINE

December 17, 2019

The Federal Reserve of Dallas President Robert S. Kaplan rated global trade uncertainty, and corporate Triple-B debt as top risks lurking around in 2020.

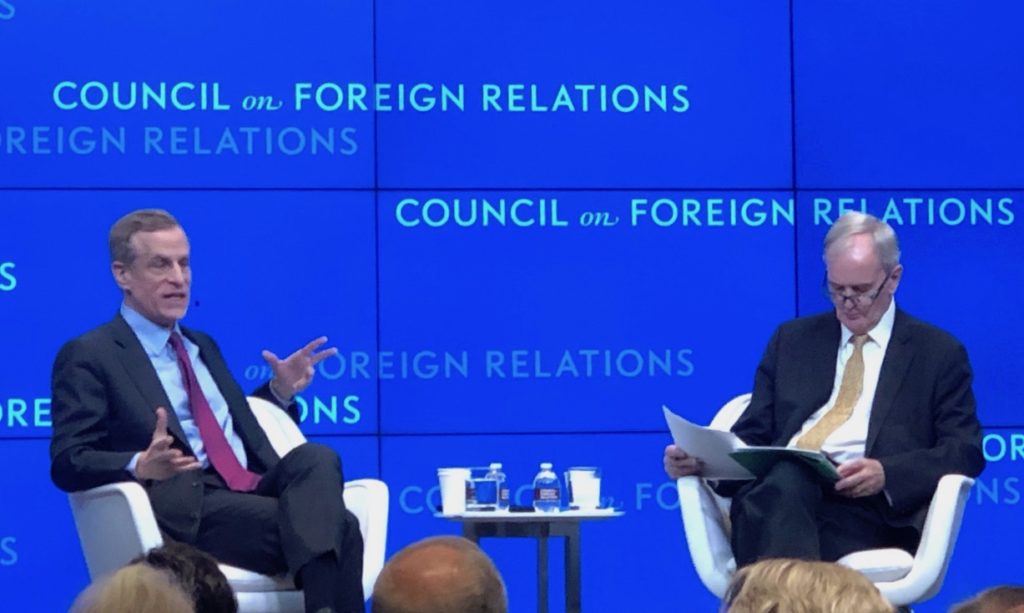

Speaking with journalists Monday shortly after giving a speech at the Council on Foreign Relations in New York, the Dallas Fed’s Kaplan said the massive amount of corporate Triple-B debt that have built up since the last financial crisis poses major future financial concerns if growth weaken and economic conditions worsen.

“I’m going to be watching carefully the path of global trade because if global trade is weaker, it means global growth is likely to be weak,” Mr. Kaplan explained. “On financial leverage, there’s a record amount of Triple-B debt, which has tripled in the United States. I will be watching carefully to see if growth improve, including growth to help stabilize those credits. I’m concerned that some of those downside risks–if there is weaken growth and downgrades, might cause a widening of credit debt, which might tighten financial conditions.”

On global trade, the Dallas Fed President said he is optimistic about a potential trade balance in the near future, which doesn’t mean all the trade issues are resolved, but may indicates some stabilization in global growth.

“For me, trade uncertainty is more than China, it’s about the relationship with Mexico, and relations with other countries and when you have news events that happen suddenly about threats of tariffs and other actions, it’s not bad or good, it just creates uncertainties and it causes businesses, at least the ones that I have talked to that say I’m not going to cancel these projects, I’m just going to wait, let’s just wait,” explained Kaplan.

Kaplan said the latest U.S.’ trade deals: U.S.Mexico Canada Agreement and the prospect trade deal with China, are hopeful signs of positive future trade outlook. Whether or not these deals represent material changes is another matter up for grab.

Asked to explain further, Kaplan said “time will tell.” He stated that the “good news” is that the phase one deal with China and the USMCA deal are underway for their votes and final endorsements, respectively, plus optimism that some of the downside for Brexit may be off the table, make the “prospect hopeful.”

“In a world where business in the U.S. is sluggish because of uncertainties and a lot of it has to do with this kind of uncertainty and to the extent that things have destabilized, I think that’s helpful to the outlook.,” he said. “The businesses that I talked to, the number one reason why they are delaying CapX and not investing is uncertainties–a lot of it has to do with trade uncertainty and uncertainty in geopolitical–so to the extent that you get some stabilization, a little better visibility, that would be helpful.”

For me, trade uncertainty is more than China, it’s about the relationship with Mexico, and relations with other countries and when you have news events that happen suddenly about threats of tariffs and other actions, it’s not bad or good, it just creates uncertainties and it causes businesses wait

– Dallas Federal Reverse President Kaplan.

While acknowledging the importance of the U.S. and China reaching a phase one trade deal as a move in the right direction for the U.S. economy and the global trade, Kaplan noted that the U.S. trade disputes with China go beyond the current trade war.

“We are [U.S. and China] globally competing, we have opportunities to cooperate, there will be issues of friction and there will be issues of cooperation. The reason why the phase one deal, it’s not that the phase one deal is so significant and it doesn’t reduce future uncertainties, it’s a stabilization at a time when people were worried that maybe tariff might be put on December 15,” Kaplan said. “It’s better if there was stabilization, but it doesn’t mean there won’t be years of issues that we’re going to be grasping with that will create some uncertainties, they will continue to.”

Elucidating on issues rated to global trade, Mr. Kaplan said the U.S. needs take advantage of the opportunities presented by globalization by leveraging those opportunities to develop U.S. human capital and productivity.

“The U.S. is aging, workforce growth is slowing, we ‘ve got a lot of work to do to improve our investment in human capital and productivity, and I think there are other countries in the world whose demographic profiles are much better than ours, have better growth prospects,” he noted.

Underscoring the necessity for globalization, Kaplan said “[globalization] is an opportunity for the U.S. to grow faster,” by investing in its human capital and productivity, which will further enhance its economic growth in the future.

Kaplan urged U.S. policymakers to implement policies that will support U.S. future workforce to respond instantly and adequately to globalization and technology disruptions. He recalled his experience as a former business person, noting that a major part of any successful business and the big part of the growth in the U.S. has been in amalgamating with the rest of the world and taking advantage of the opportunities those mergers offer.

“I’m cognizant of the narrative in the U.S. right now and many other areas of the world that globalization is more of a threat, particularly for workers that have been displaced and have seen their jobs structurally eliminated, a lot of that is being attributed to globalization,” Kaplan said. “I’m pointing out based on our research [at the Dallas Fed] that that analysis might have been true 15 years ago, but today it’s more likely that those job displacements and restructurings have a lot more to do with technology and technology-enabled disruptions that’s going on within the U.S., and the reason I pointed that out is I think if [the U.S.] get that diagnosis wrong, the danger is we’ll implement policies that might cause us to grow more slowly at a time when we need to increase our growth.”

Speak of the economy and maintaining financial stability, and lurking financial risks, Kaplan highlighted the excess corporate debt as lurking financial risks in the economy that he is keeping another closer eye on.

“In terms of excesses and balances, I have talked, for example about the record amount of corporate debt, business debt to GDP in the U.S. I believe risk is manageable, but it’s likely to be an amplifier in the downturn,” said Kaplan, noting that build up of debt in a downturn will be difficult to manage and deal with.

“When interest rate is running this low for an extended period of time, it’s likely that private equity are likely to expand, cap rate are likely to go down, credit rate are likely to be tighter, and more likely to have more debt issuance, debt is less cost to equity,” he said. These issues have to be monitored. “The one thing that helps with this assessment is we have more tougher stress testing and capital requirement for the banks. I think that is an underpinning that we didn’t have before and I think that helps in assessing all of these issues.”

Kaplan’s comments about the increase in Triple-B corporate debt echoed other global monetary policymakers’ growing concerns, including the International Monetary Fund’s Managing Director Kristalina Georgieva and former U.S. Treasury Secretary Timothy Geithner, about corporate debt tipping over the edge. Since the 2007-2008 financial crisis, the corporate triple-B debt has exploded amid massive corporate burrowing spree due to cheap burrowing costs. Monetary policymakers are worried that if economic worse, companies might struggle to pay back or refinance their hug debt, which will result in downgrades.

According to a recent Fitch Rating report, $105 billion to $215 billion of triple-B debt is likely to be downgraded during the next economic downturn. The report concluded that triple-B rated company cash flows and net leverage are such that, in aggregate, they should be able to repay their existing debt.

Kaplan said appropriate measures can be taken to counter cyclical capital such as keeping consistently tough capital requirement and stress testing for the big banks.

“I think having a high level of capital requirements and stress testing is appropriate. For smaller and mid-sized banks, the effort to tally financial regulations and give them some streamlining is appropriate. They weren’t the prime caused of the financial crisis the last time,” said the Dallas Fed President. “That doesn’t mean the [Fed] don’t want to make changes to provide clarity and to make some improvement, but I think while we’re doing that, it’s critical that we have very tough capital requirements and very tough stress testing on the big banks. I think it has served us well so far and I think it will continue to serve us well.”