By Africa Bazaar StaffWriter | October 6, 2025

As Americans brace for another spike in Obamacare premiums and out-of-pocket costs, it’s easy to see this as a purely domestic story. But for Africa and its diaspora, the financial ripple effects are real, immediate, and profound.

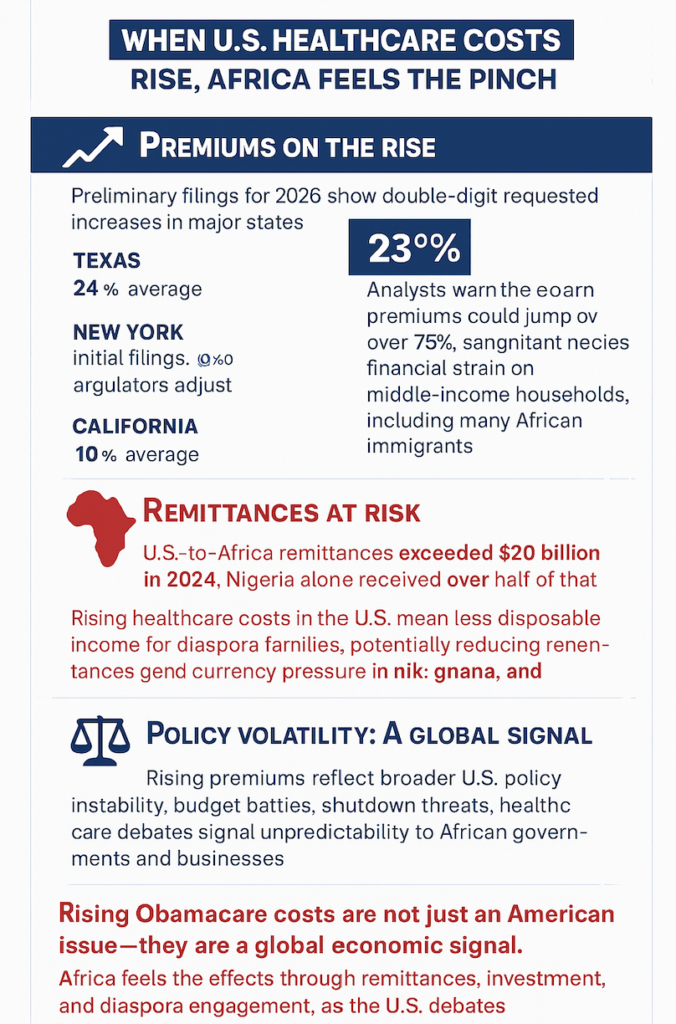

Health insurance premiums in the U.S. are rising. According to preliminary filings for the 2026 plan year, which show double-digit increases in major states like California, Georgia, New York and Texas. In some filings, requested hikes surpass 30–60 percent, though state regulators may approve lower final rates. Meanwhile, the looming expiration of enhanced premium tax credits could push net premiums even higher for millions of Americans. Copays, deductibles, and other out-of-pocket costs may also increase, particularly for middle-income households who do not qualify for subsidies.

For the African diaspora—who often work in service, care, technology, and small business sectors—this matters. Many rely on ACA marketplace plans for themselves and their families. Rising healthcare costs mean less disposable income. Less disposable income means fewer dollars sent home.

Remittances are a critical economic lifeline for Africa. In 2024, U.S.-based African immigrants sent more than $20 billion back home, with Nigeria alone receiving over half of that total. These flows support daily living expenses, education, healthcare, and small business development.

If ACA premiums and copays rise sharply, diaspora families may reduce remittances, cutting a crucial source of income for millions. This could have knock-on effects on household consumption, local businesses, and even currency stability in countries like Nigeria, Ghana, and Kenya, where remittances account for a sizable share of GDP.

RELATED STORY: Hidden Gems: Africans in the Diaspora:

Investment and Entrepreneurship

The African diaspora is not just a source of remittances—it is also an emerging force for investment in Africa. Diaspora investors back startups in fintech, agriculture, logistics, and real estate. Higher U.S. living costs could shrink their capacity to invest, slowing innovation and growth. Smaller businesses and early-stage ventures are particularly vulnerable to this funding contraction.

If ACA premiums and copays rise sharply, diaspora families may reduce remittances, cutting a crucial source of income for millions.

Moreover, diaspora-led investment often carries intangible benefits: skills transfer, mentorship, and global networking. Rising healthcare costs in the U.S. could indirectly limit these positive externalities, creating a subtle but lasting drag on African entrepreneurial ecosystems.

PARTNER’S PRODUCT

Save up to 52% on Gruns the most comprehensive green gummies.

Rising premiums are part of a broader narrative of U.S. policy instability. Domestic debates over budgetary priorities, shutdown threats, and healthcare subsidies signal to African policymakers and business leaders that U.S. reliability as a partner is less predictable. For countries negotiating trade deals, infrastructure investment, or regulatory harmonization with the U.S., this uncertainty complicates planning.

It also has diplomatic implications. African governments and diaspora organizations may increasingly look to Europe, China, and other global partners for more predictable trade, aid, and investment. Washington’s domestic health policy struggles could therefore indirectly shift the geopolitical balance in Africa over time.

Community Impacts and What Can Be Done?

Obamacare premium increases are not just a U.S. issue. They are a global economic signal, touching lives across oceans. For Africa, the effects will ripple through remittances, investment, and community well-being. Within U.S. borders, African immigrant communities facing rising costs will have to make tough choices between health vs generosity. Rising premiums may push households to delay or skip preventive care, seek lower-cost or nonprofit health plans and consolidate family coverage in riskier or limited-network plans

Experts say these choices have health consequences, affecting productivity, long-term earnings, and community well-being. They also reduce the diaspora’s ability to support initiatives and philanthropy back home.

As the United States debates its own healthcare future, African policymakers, business leaders, and communities have a stake in the outcome. What happens in Washington does not stay in Washington—it reaches across continents, affecting wallets, families, and economies thousands of miles away.

With the right policy responses, Congress could extend or expand enhanced premium tax credits, mitigating the sharpest impacts on disposable income. States could implement targeted subsidies or cost-sharing reductions for low- and middle-income immigrant families. And African diaspora organizations can advocate for policies that protect their communities while maintaining connections to home countries.

For African governments, understanding the sensitivity of remittances to U.S. domestic policy is crucial. Programs that reduce dependence on a single external source or that leverage diaspora investment more strategically could help buffer economies from shocks like rising healthcare costs in the U.S.