A Market Hiding in Plain Sight

By AFRICA BAZAAR Staffwriter | October 10, 2025

When global executives talk about Africa, the tone is often the same — optimistic, urgent, and slightly competitive. The continent, after all, is home to some of the world’s fastest-growing economies and youngest populations. Financial services, telecoms, and consumer brands are pouring in to capture what they call “the unbanked.”

But amid this gold rush, there’s a quieter, less crowded frontier — one that rarely makes the slides of corporate strategy meetings.

It’s the African diaspora, a growing network of educated, globally mobile, and increasingly affluent consumers shaping economies on both sides of the Atlantic.

The Missed Opportunity

From London to Atlanta to Toronto, millions of Africans abroad are building wealth, buying homes, and sending money back home in volumes that rival foreign aid. Yet, for many global companies, they remain invisible.

While corporations chase new customers across Africa’s megacities, few have considered the African professionals, entrepreneurs, and families living abroad as a market in their own right.

“The diaspora is the most misunderstood consumer demographic in the global economy,” says a business strategist. “They’re educated, connected, and culturally grounded. But brands and banks treat them as an afterthought — if they think of them at all.”

A Fast-Growing, Wealth-Generating Community

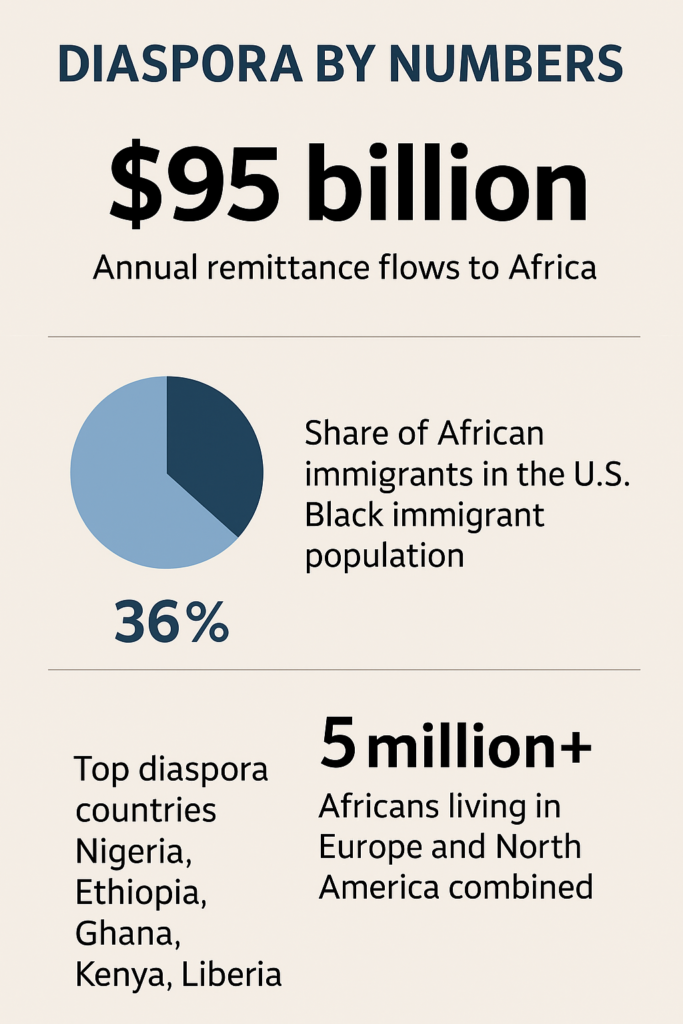

According to a Pew Research Center report by Monica Anderson, African immigrants now make up 36 percent of all Black immigrants in the United States, up from just 7 percent in 1980. Most come from Nigeria, Ethiopia, Ghana, Kenya, and Liberia, bringing with them high levels of education and professional achievements.

The next phase of Africa’s economic story won’t be written solely on the continent — it will be shaped in the diaspora’s boardrooms, kitchens, and group chats.

They’re doctors, engineers, financiers, and creatives. And they’re reshaping what it means to be African in the global marketplace.

PARTNER’S PRODUCT

Remittances from this group topped $95 billion in 2023, according to the World Bank Group — outpacing foreign direct investment in many African nations. Behind those transfers are deeply personal stories: tuition payments for relatives, land purchases, startup funding, and community building.

Family, Faith, and Financial Freedom

To understand this market, experts say, you have to understand its value system.

For many in the diaspora, family, education, and community are central. Success isn’t defined only by wealth, but by the ability to support others. That’s why financial decisions are often collective — savings circles, co-investments, and remittances that sustain extended families and entire villages. For example, when an African immigrant buys a home or invests in a business, it’s rarely just for themselves. They’re building transnational wealth — something that links them to both continents at once.

Despite this economic power, most companies lack meaningful data on African diaspora consumers. Market research firms rarely break them out as a distinct demographic, often lumping them into broad “Black” or “immigrant” categories that miss cultural nuances.The result: products that don’t fit, campaigns that don’t resonate, and financial services that feel tone-deaf.

For instance, estate planning or long-term insurance products rarely address the reality of multi-country obligations — dependents spread across continents, or dual investment strategies that blend property in Lagos with retirement planning in London.

Understanding cultural context isn’t just sensitivity — it’s strategy. If you know what drives this group, you’ll know how to build for them.

PARTNER’S PRODUCT: LOOKING FOR LAST-MINUTE AIRLINE DEALS? CHECK OUT THESE GREAT OFFERS TO AFRICAN COUNTRIES FROM QATAR AIRWAYS

The Afropolitan Generation: A New Soft Power Strategy

A new wave of diaspora Africans — often called Afropolitans — is redefining global identity.

They are tech founders in Lagos and Nairobi with MBAs from some of American top universities like Columbia, Harvard, MIT, Stanford, Yale or second-generation immigrants in London or Berlin creating fashion labels that bridge cultures.

They are digitally native, brand-conscious, and globally ambitious — yet they maintain strong cultural and family ties to Africa.

Their purchasing decisions reflect this duality: global tastes, African values. They might invest in real estate in Accra while driving a Tesla in Washington, D.C. For brands willing to listen, this blend of cultural pride and global sophistication offers fertile ground.

The financial implications are vast. Africans abroad are not only sending money — they’re investing it. From real estate and renewable energy to tech startups, diaspora capital is now a pillar of African development.

Financial institutions that once focused on charity-based remittance services are shifting toward investment-oriented platforms, catering to diaspora clients looking for equity returns and cross-border partnerships.

Still, many opportunities remain untapped. Most Western banks and insurers have yet to build diaspora-specific divisions or products.

“The diaspora is Africa’s soft power. They’re the bridge between global capital and local opportunity — if businesses know how to engage them,” experts noted.

The next phase of Africa’s economic story won’t be written solely on the continent — it will be shaped in the diaspora’s boardrooms, kitchens, and group chats.

To reach this market, businesses must shift their approach. That means: Investing in cultural intelligence and diaspora data, designing financial products that recognize dual-continent lifestyles, and building marketing narratives rooted in family, aspiration, and heritage.

This isn’t just a moral imperative — it’s a market advantage.

For decades, companies have viewed Africa through a narrow lens — as a place of emerging consumers rather than global citizens. But the diaspora defies that view. It is Africa’s most mobile, educated, and wealth-building generation — a bridge between continents, cultures, and capital.

Those who understand this dual identity will not just sell to Africa; they’ll grow with it. And in the process, they may discover that the “next big thing” was never across the ocean — it was already here.

AFFILIATE PARTNER’S PRODUCT